How to Get Started in Commercial Real Estate Investing

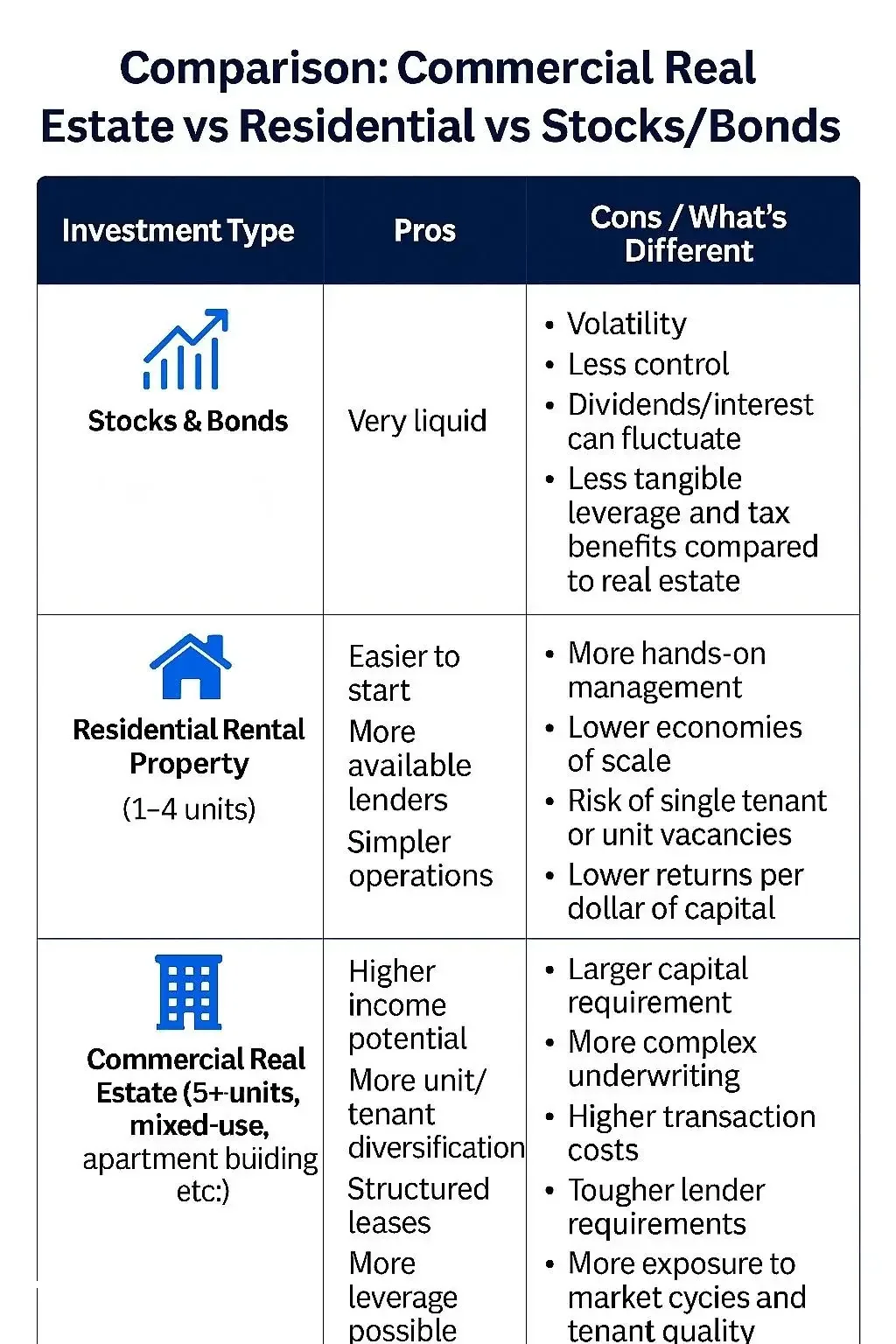

If you’ve been considering moving beyond stocks, bonds, or 1-2 unit investment properties into commercial real estate, this guide lays out why, what skills help, how it compares to other investments, and step-by-step how to move in.

Why Someone Might Invest in Commercial Real Estate

Income & Cash Flow Potential: Commercial properties tend to have multiple tenants or units, longer leases, and more predictable cash flow once stabilized compared to residential investment properties.

Leverage and Scale: You can acquire larger assets, use financing to multiply returns, and spread risk over more units/tenants.

Diversification: Having commercial in your portfolio (alongside residential, stocks, bonds) helps reduce correlation risk. If one market softens, others might hold up.

Partnership & Structuring Opportunities: Ownership via an LLC or partnership allows pooling of resources, dividing risk, and leveraging expertise.

Balancing a portfolio with residential + commercial + financial assets = more stability and higher upside over time.

What Skills & Interests Align Well

These tend to be traits and skills that successful commercial real estate investors have:

Strong financial analysis skills (NOI, cap rates, DSCR, cash flow)

Patience and long-term mindset — you’ll often hold, renovate, lease out, or reposition before you realize major returns

Willingness to learn real estate markets, zoning, property operations, leasing

Networking ability (finding deals, partners, and capital)

Risk awareness — understanding vacancy risk, market cycles, financing cost changes

How One Could Enter the CRE Investor Space

Here’s a typical pathway step by step, from beginner to more advanced:

Start with Primary Residence — live there, build equity; gain comfort with mortgages, payments, property ownership.

Acquire 2-4 Residential Investment Properties — smaller scale; learn property management, lease issues, cash flow, maintenance. Manage for 12+ months.

Step up to 5+ Unit Multifamily or Mixed-Use Property — commercial financing begins to play a bigger role; more units = more income and diversification; you may need more experience or a partner.

Advantages & Challenges of Commercial Side

Advantages:

Operating via an LLC or partnership which limits liability.

Ability to bring in partners with complementary skills: one partner contributes capital, another contributes CRE experience (e.g. asset management, construction, leasing).

More flexible capital stacks (senior debt, mezzanine, preferred equity) for funding large projects.

Challenges:

Down payments are larger (often 20%+ or more).

Lenders scrutinize experience heavily. Even with strong cash / equity, lack of CRE track record may lead to higher interest rates, stricter covenants, lower leverage.

Experience Requirements by Asset Class

The minimum level of experience expected by lenders or equity partners tends to vary by property type / deal size:

For smaller multifamily / mixed-use (5-50 units): lenders often accept investors with a few residential properties, maybe one or two small commercial deals; demonstrated ability to manage leases and operations.

For larger multifamily / institutional assets: often require track record, meaning previous ownership or management of similar size properties; sometimes experience via partnership with a seasoned sponsor.

For specialty classes (office, retail, hospitality, industrial): lenders may require experience in that specific sector (tenant leasing types, maintenance, lease structures) because risk profiles differ.

Key Takeaways & How FCAR Capital Advisors Can Help

Even if you’re inexperienced, you can enter commercial real estate investing if you bring strong equity (cash) and partner with someone who has relevant CRE experience.

Structuring matters: LLCs, partnerships, proper contracts, good underwriting, solid occupancy, etc., are all critical.

Terms improve with track record. Start small, build credibility and cash flow.

At FCAR Capital Advisors, we help ambitious investors take these steps — from structuring your first small multifamily deal up through larger commercial acquisitions. We can connect you with capital, guide you through underwriting, and help you partner where needed so your vision becomes reality.