The Cash Cow: Building or Fix & Holding Short-Term Rental 1–4 Unit Properties

What Is the Strategy?

Short-term rentals (STRs), often listed on platforms like Airbnb and VRBO, have exploded as a profitable investment strategy. Instead of renting out a 1–4 unit property on a traditional 12-month lease, investors design these assets specifically for short-term use—often by building new homes with STR layouts in mind or renovating older properties to attract guests.

When done with due diligence, STRs can perform exceptionally well compared to traditional rentals, offering strong cash flow and attractive returns.

Why They Can Be Cash Cows

Unlike long-term rentals, STRs generate revenue on a nightly basis, often with premium pricing in popular markets. When occupancy and pricing are optimized, investors see:

High Cash Flow – Revenues often outpace standard rental income.

Attractive Returns – Strong demand and daily rental flexibility provide upside.

Scalability – Investors can replicate the model across multiple properties or markets.

At FCAR Capital Advisors, we’ve seen these projects consistently deliver outsized returns when investors carefully evaluate location, regulations, and operating costs before entering the market.

At FCAR Capital Advisors, we’ve seen these STR projects consistently deliver outsized returns when investors carefully evaluate location, rent comps, regulations, and operating costs before entering the market.

Financing Advantage

While many assume STR-specific projects would be harder to finance, the opposite is often true. Lenders and private capital sources increasingly view STRs as a desirable asset class because of their historical performance. In fact, investors familiar with STRs may show more interest in financing these projects than certain traditional long-term rentals.

Through our network, FCAR Capital can align clients with capital investors that allow for:

Lower down payments (10–15%) for acquisitions

Up to 100% of the construction budget financed

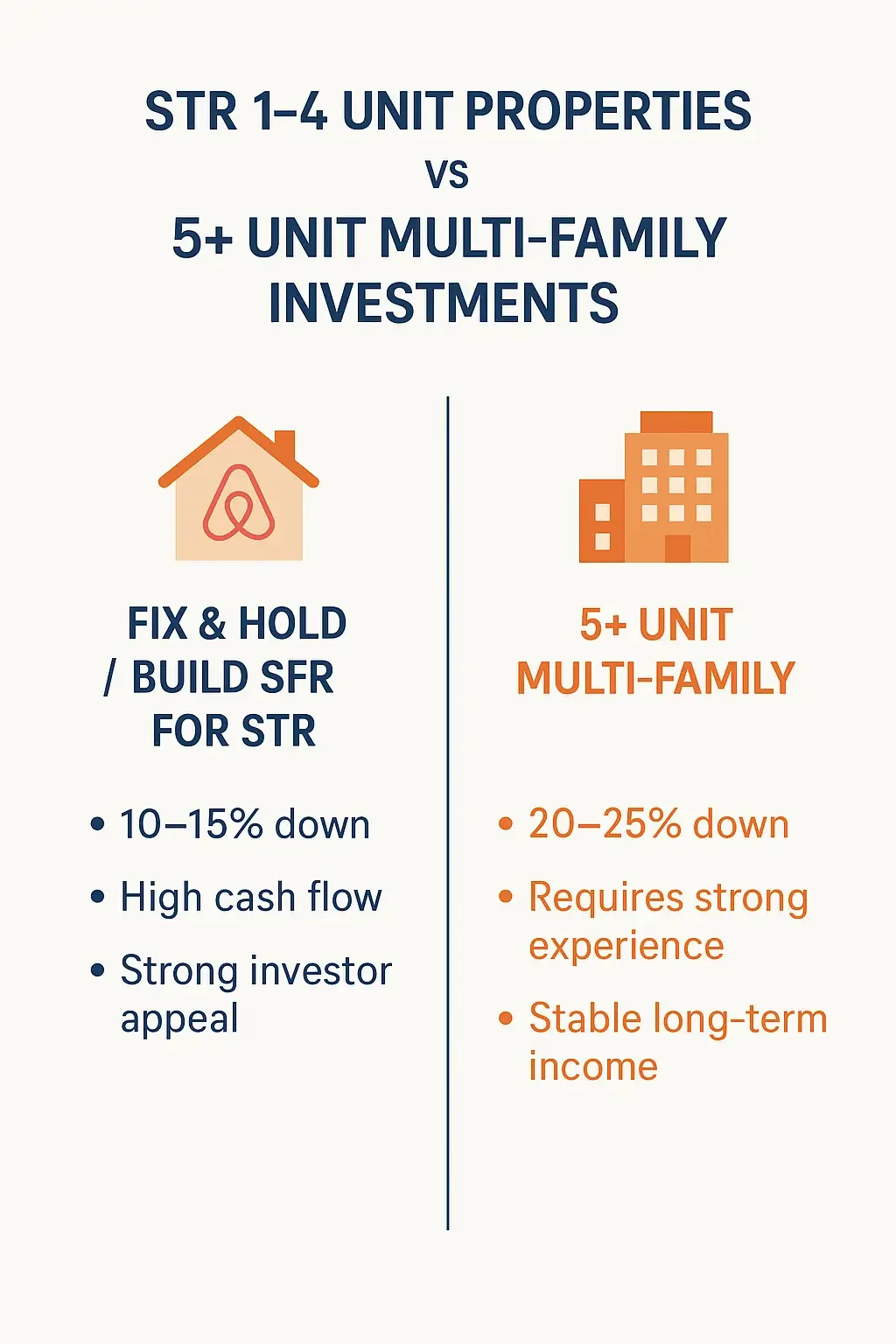

This creates a much lower barrier to entry compared to traditional commercial acquisitions like a 5+ unit multifamily building, which often requires 20–25% down plus proven investor experience.

Partnership Structures That Work

Many successful STR projects are built around LLC partnerships. Common structures include:

A GC/builder/flipper who brings construction experience, combined with a partner who provides the equity.

A seasoned real estate investor with capital who partners with a builder/GC to execute the rehab or build.

Groups that pool capital and experience to collectively reduce risk and maximize returns.

This approach not only shares risk but also strengthens the financing profile of the deal.

Not Quite Residential, Not Quite Commercial

Financing STR 1–4 unit investor properties sits in a unique middle ground:

Not purely residential – Some residential lenders don’t offer this type of loan qualification.

Not strictly commercial – These aren’t large multi-family or office buildings.

That’s where FCAR Capital Advisors bridges the gap. We connect clients with capital partners who understand this strategy, allowing them to secure better leverage and terms than they would find in either the residential or commercial lending space alone.

Strategy Takeaway

Short-term rental 1–4 unit properties can truly be cash cows for investors who combine smart partnerships, sound due diligence, and the right financing. At FCAR Capital Advisors, we help align strategy with capital so our clients can acquire, build, or rehab STR properties that deliver outsized returns.