The Capital Blog

FCAR Capital Knowledge Vault

Medallion University

11 Financial Tactics Wealthy People Use to Build and Protect Their Money

Through careful structuring, tax planning, and disciplined investing, affluent individuals build wealth that grows quietly and efficiently behind the scenes.

The good news? Many of these same principles are available to everyday business owners and investors.

The Cash Cow: Building or Fix & Holding Short-Term Rental 1–4 Unit Properties

Short-term rentals (STRs), often listed on platforms like Airbnb and VRBO, have exploded as a profitable investment strategy. Instead of renting out a 1–4 unit property on a traditional 12-month lease, investors design these assets specifically for short-term use—often by building new homes with STR layouts in mind or renovating older properties to attract guests.

How to Get Started in Commercial Real Estate Investing

If you’ve been considering moving beyond stocks, bonds, or single-family homes into commercial real estate, this guide lays out why, what skills help, how it compares to other investments, and step-by-step how to move in.

Residential vs. Commercial Loan Qualifications: What Partners Need to Know

Many residential loan officers are well-versed in Fannie Mae, Freddie Mac, FHA, and VA guidelines for home loans. But when it comes to commercial financing, the rules change dramatically. This blog breaks down the key differences.

Commercial Loan Underwriting Explained: What Borrowers Need to Know

When you apply for financing on an income-producing property, the lender doesn’t just look at you — they look at the property itself as a business. This process, called commercial loan underwriting, determines whether the deal makes financial sense and what terms the lender can offer.

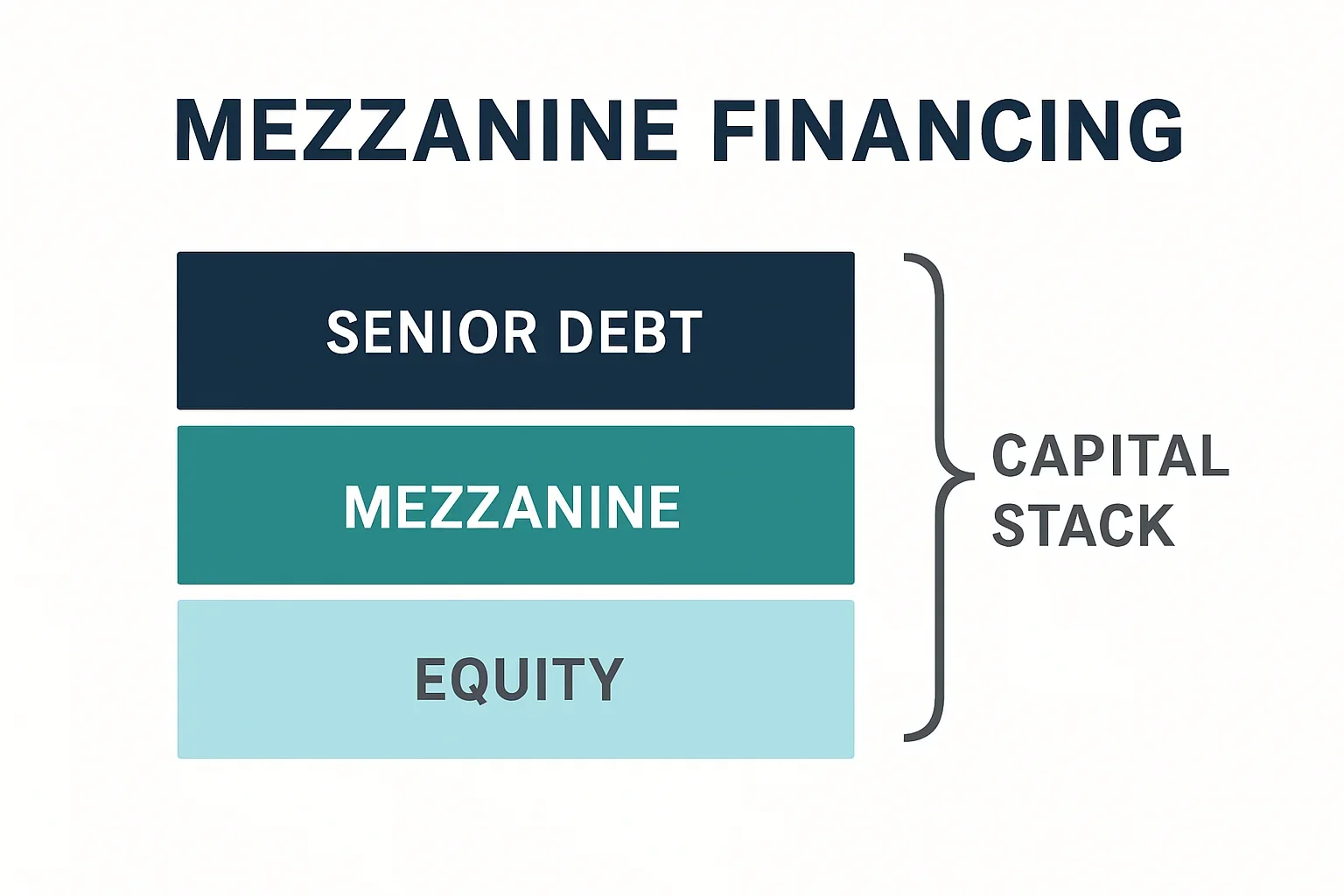

What is Mezzanine Financing? A Flexible Layer of Capital for Growth

Think of mezzanine financing like adding a second floor onto a house. The foundation (senior debt) supports most of the structure, but the mezzanine adds space and flexibility — allowing the project to reach higher than it could with the foundation alone.

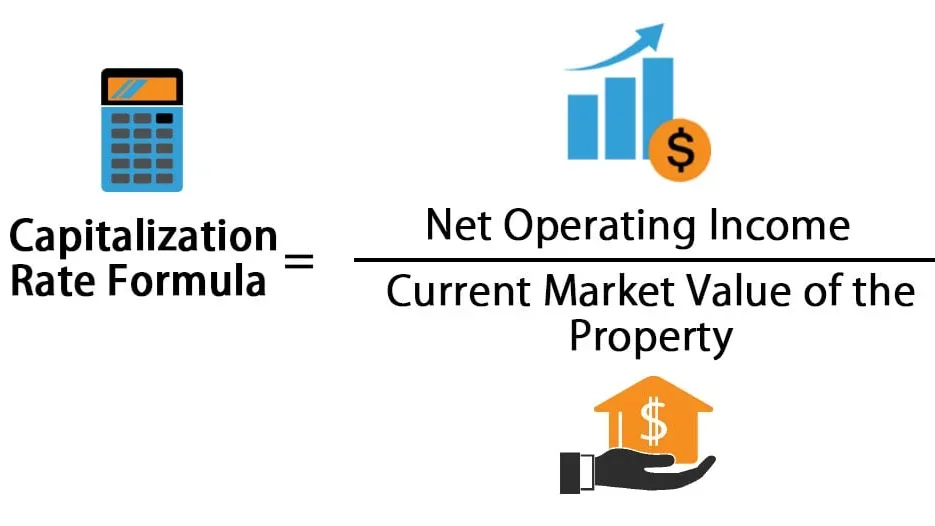

What is a Cap Rate? A Key Metric in Commercial Real Estate Investing

Think of a cap rate like the “yield” on a bond. Just as bonds pay interest relative to what you paid for them, a cap rate tells you the annual return a property generates relative to its price — before factoring in financing, taxes, or future growth.

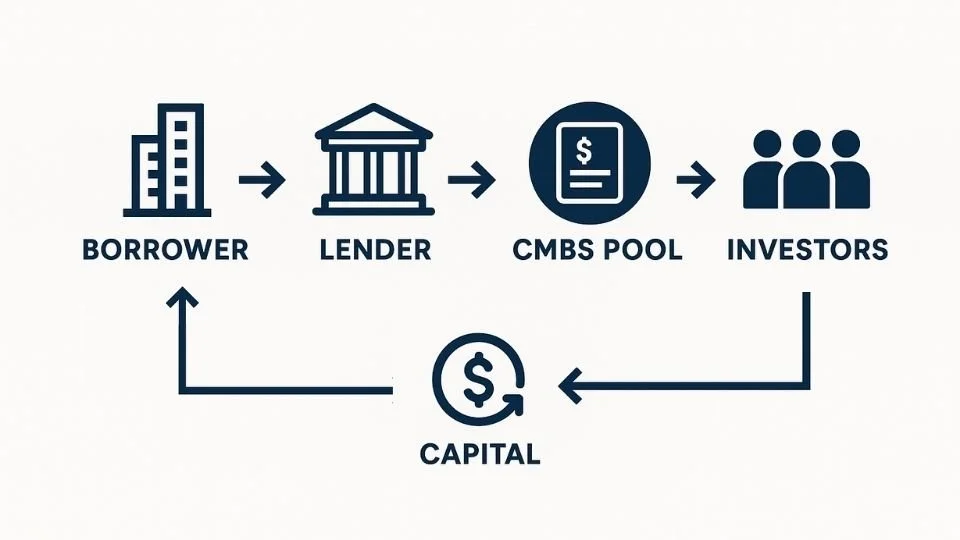

What is CMBS? A Simple Guide for Investors

CMBS is often discussed as a Wall Street investment product. But it’s equally important to understand CMBS from the borrower’s perspective — because behind those securities are the very loans that help business operators and investors like you access capital for real estate projects.

SBA Loans: What Operators Should Know

SBA (Small Business Administration) loans are government-backed financing tools designed to help small and medium businesses access capital under favorable terms. Two of the most popular SBA types are 7(a) and 504. Each is suited to different needs — knowing the difference can help you choose the right path.

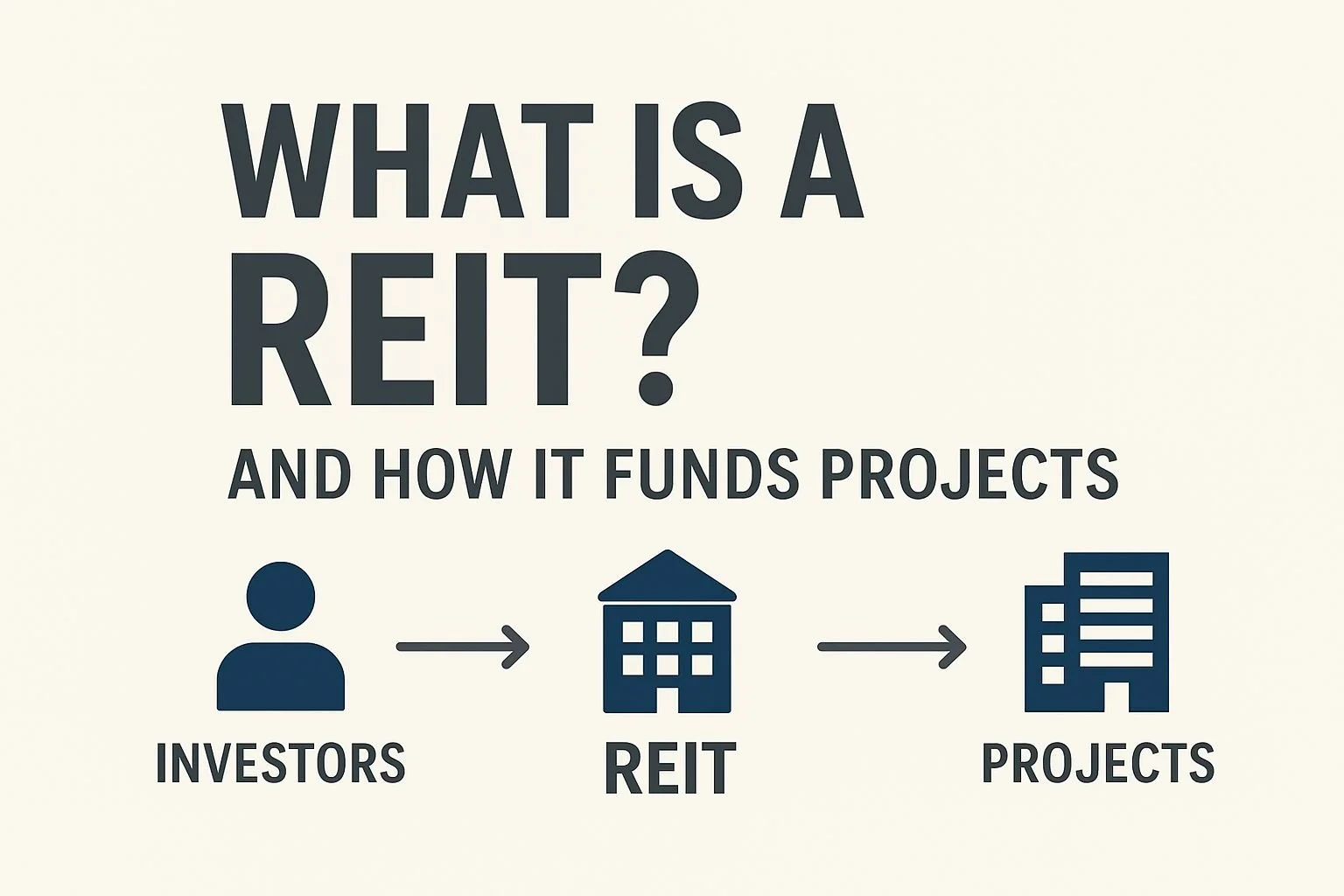

What is a REIT? Understanding REIT-Backed Debt for Commercial Property Investors

Some REITs don’t just own property, they also provide debt financing to projects and can be a direct source of capital for your acquisition, refinance, or redevelopment.