What is a REIT? Understanding REIT-Backed Debt for Commercial Property Investors

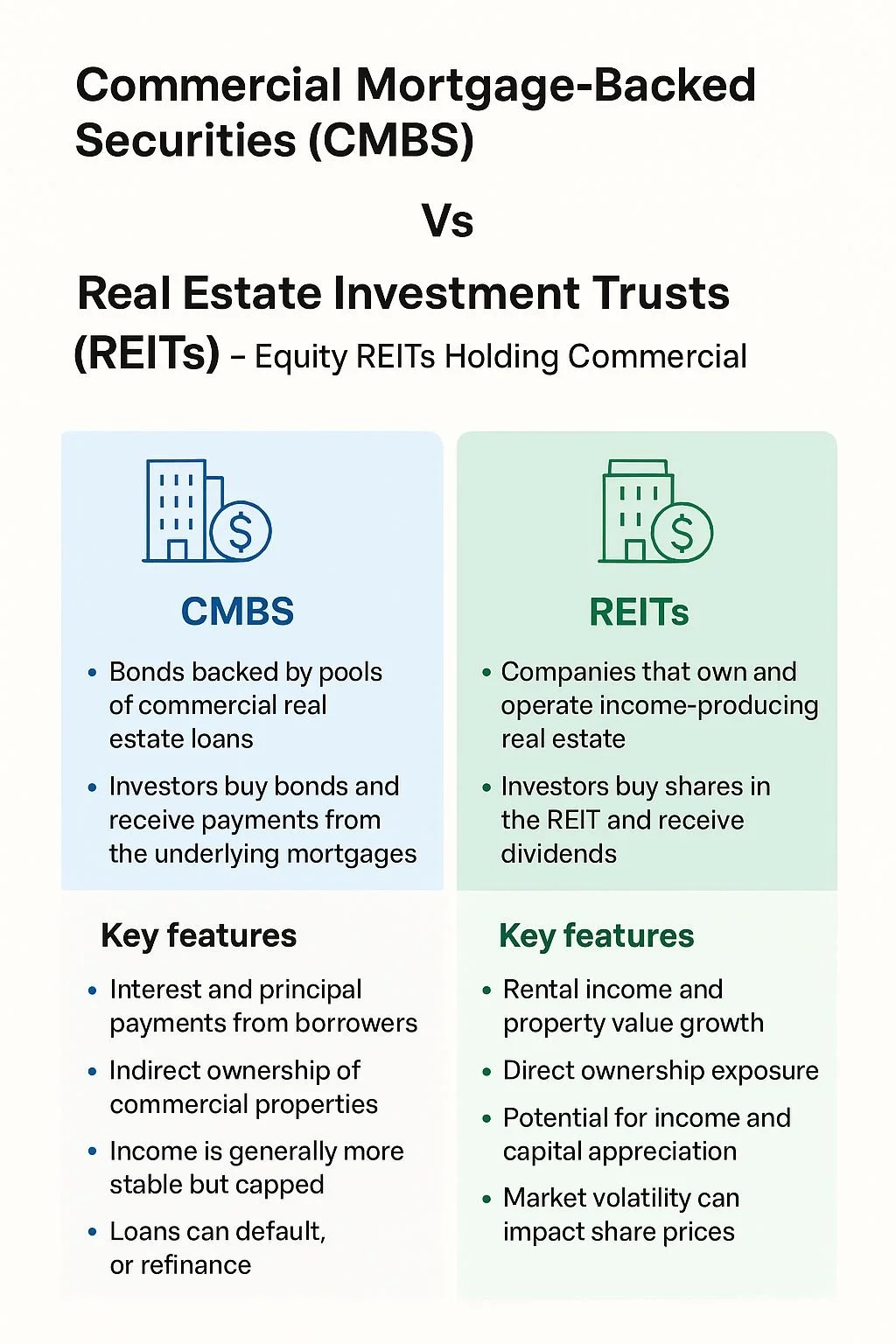

When it comes to commercial real estate financing, one powerful tool that’s often overlooked by business operators and property investors is the REIT — short for Real Estate Investment Trust.

What is a REIT?

A REIT is a company that owns, operates, or finances income-producing real estate. Think of it like a mutual fund for real estate: instead of individuals buying one building, a REIT pools capital from many investors to own or finance a portfolio of properties.

For borrowers, the key piece is this: some REITs don’t just own property, they also provide debt financing to projects, meaning they can become a direct source of capital for your acquisition, refinance, or redevelopment.

How REITs Fund Projects

Because REITs have access to large pools of capital, they can step in as lenders for commercial properties. This creates opportunities for borrowers to tap into non-traditional, institutional-grade financing that’s competitive with (and sometimes more flexible than) what a bank or CMBS lender might offer.

For example:

A multifamily investor looking to acquire a Class A building in a major metro could secure long-term REIT-backed financing.

A business operator refinancing a stabilized industrial property may access customized loan structures that align with investor return expectations.

Pros of REIT-Backed Debt

Deep Capital Pools – REITs manage billions, meaning they can fund sizable projects.

Flexible Structures – Debt can be tailored to project needs and investment horizons.

Institutional Stability – Backed by regulated, publicly traded companies in many cases.

Speed & Efficiency – Some REIT lenders move faster than traditional banks.

Cons of REIT-Backed Debt

Pricing May Be Higher – Rates or fees can reflect investor return requirements.

Limited Relationship Banking – REITs are less about long-term relationships and more about transactional performance.

Selective Lending – Not all projects or asset types fit REIT mandates.

Final Takeaways

REITs are more than just vehicles for investors — they can also be a source of capital for business operators and property owners. By leveraging REIT-backed debt, you may be able to structure financing that aligns with both your project goals and the return expectations of institutional investors.

At FCAR Capital Advisors, we specialize in navigating this space and connecting clients with REIT-backed lending solutions that bring visions to reality.