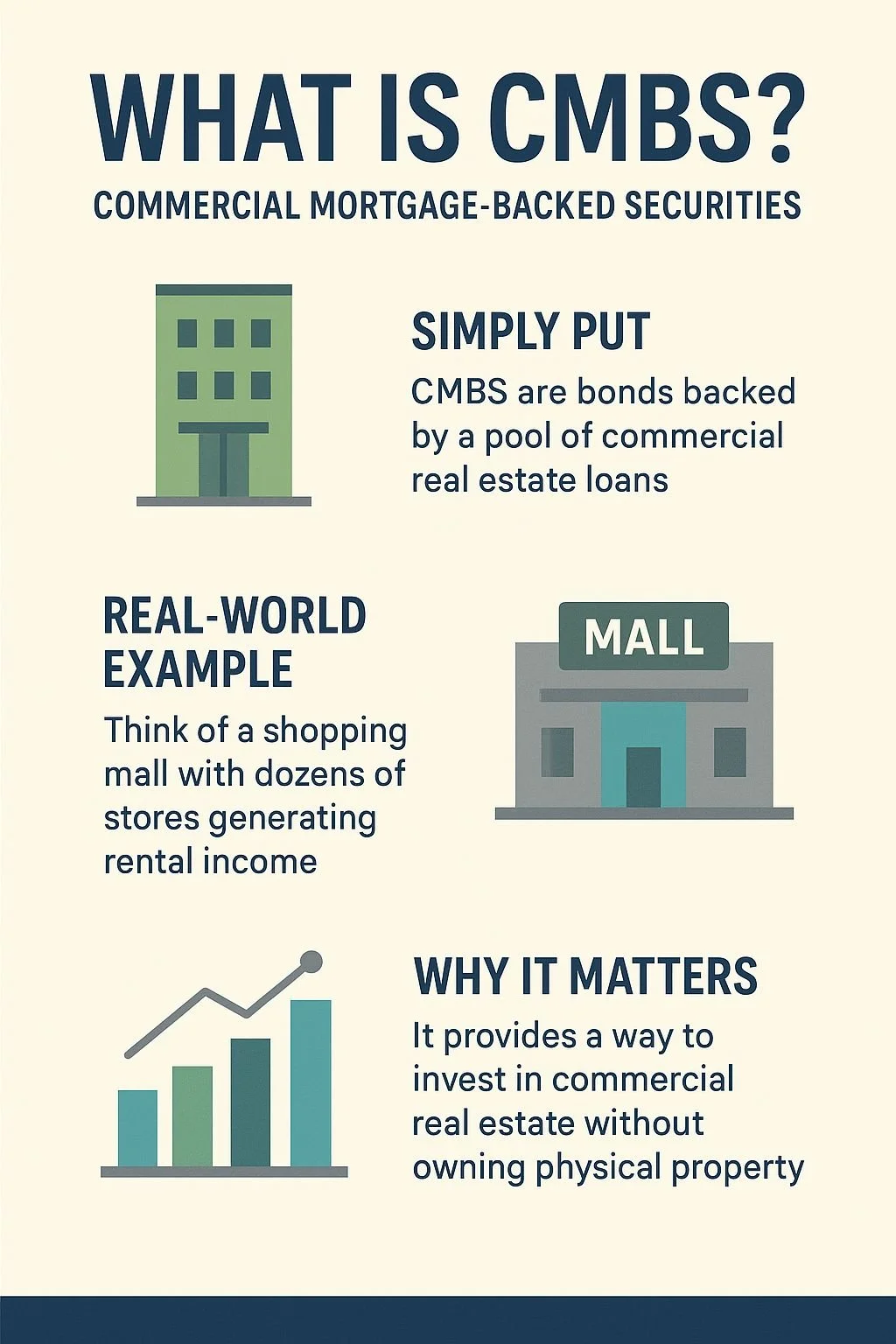

What is CMBS? A Simple Guide for Investors

If you’ve ever looked into financing options for a commercial property purchase or refinance, you may have heard the term CMBS. Short for Commercial Mortgage-Backed Securities, CMBS is often discussed as a Wall Street investment product. But it’s equally important to understand CMBS from the borrower’s perspective — because behind those securities are the very loans that help business operators and investors like you access capital for real estate projects.

CMBS in Simple Terms

At its core, CMBS are bonds backed by commercial real estate mortgages. Here’s how it works:

A bank or lender originates a commercial mortgage loan — say, for an apartment complex, retail center, hotel, or office building.

Instead of keeping that loan on its books, the lender sells it into a larger pool with many other loans.

That pool is used to issue bonds (the CMBS), which investors buy.

The investors receive payments from the mortgage borrowers — meaning your loan payments flow through to the bondholders.

Think Of It This Way

Think of it like a shopping mall. Each store pays rent to the mall owner. The mall owner then distributes that rental income to investors who funded the mall.

With CMBS, your loan is one of many “stores” in a big portfolio. The investors buying CMBS bonds are essentially funding your project, and in return, they receive income from your loan payments.

Why This Matters for Borrowers

For you as a business operator or investor, CMBS loans are simply another debt vehicle — but one with some distinct advantages:

More Capital Availability – Because loans are pooled and sold to investors, lenders can make larger loans than they might otherwise keep on their own balance sheet.

Non-Recourse Financing – Many CMBS loans are non-recourse, protecting your personal assets while tying repayment primarily to the property itself.

Longer Terms & Amortizations – You may see amortizations of 25–30 years, creating better cash flow.

Institutional Capital Access – You’re effectively tapping into Wall Street’s capital markets — giving you access to deeper pools of funds beyond traditional banks.

Risks to Keep in Mind

Prepayment Restrictions – Exiting early can be expensive due to yield maintenance or defeasance penalties.

Servicing is More Impersonal – Because loans are securitized, servicing is handled by third parties rather than your local banker.

Less Flexibility Post-Closing – Modifications are harder because your loan is part of a large, structured pool.

The Bottom Line

From the investor side, CMBS are a way to gain exposure to commercial real estate debt. From the borrower side, those very investors are the source of funds that make your financing possible.

At FCAR Capital, we help clients leverage CMBS loans to purchase, refinance, or reposition commercial properties — guiding you through deal structuring, lender selection, and the nuances of this powerful debt vehicle.

👉 For operators and investors seeking institutional-level capital with favorable terms, CMBS can open the door to new opportunities — and we’re here to help you unlock them.