What is a Cap Rate? A Key Metric in Commercial Real Estate Investing

When evaluating commercial properties, one of the most widely used tools is the capitalization rate, or cap rate. It’s a simple calculation that gives investors a quick snapshot of a property’s potential return, helping compare opportunities across markets and asset types.

Cap Rate in Simple Terms

The cap rate is the ratio of a property’s net operating income (NOI) to its purchase price (or current market value).

Cap Rate Formula courtesy of FCAR Capital

Think of a cap rate like the “yield” on a bond. Just as bonds pay interest relative to what you paid for them, a cap rate tells you the annual return a property generates relative to its price — before factoring in financing, taxes, or future growth.

Why Cap Rates Matter

For investors and operators, cap rates help with:

Comparisons – Easily measure different properties on an “apples-to-apples” basis.

Risk Assessment – Higher cap rates often mean higher perceived risk (secondary markets, older assets, less stable tenants). Lower cap rates signal lower risk (prime locations, strong tenants).

Valuation – Market cap rates influence what buyers are willing to pay for a property based on its NOI.

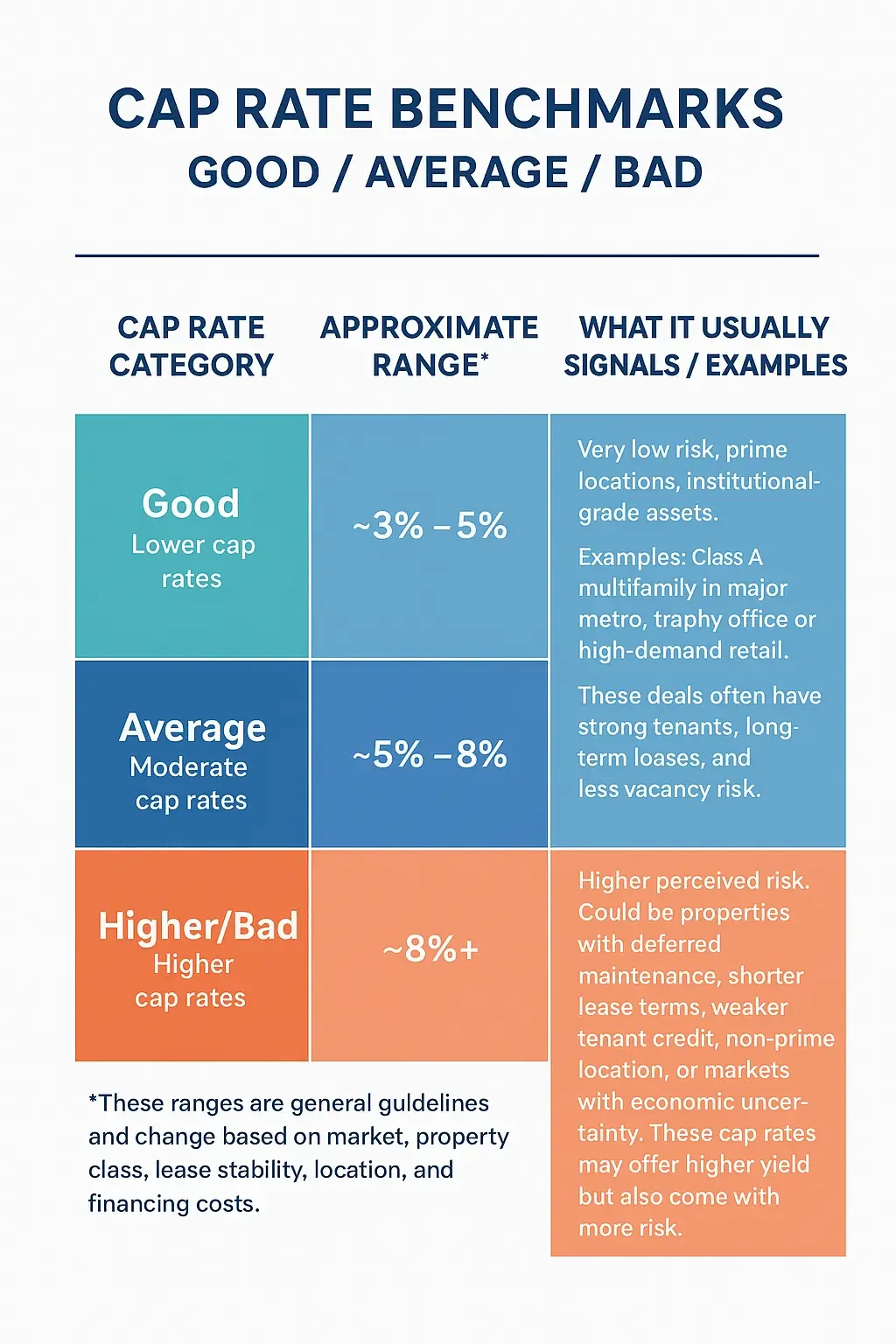

Cap Rate Benchmarks courtesy of FCAR Capital Advisors

How to Use These Benchmarks

Use lower cap rate properties if you want stability, lower risk, or strategic prestige.

Use moderate cap rate properties if you’re looking for a mix of return and manageable risk—often better for value-add or rehab projects.

Use higher cap rate properties if your strategy accepts higher risk in exchange for higher yield (but make sure you underwrite carefully).

Benefits of Using Cap Rates

Quick Benchmark – Simple way to screen deals.

Market Insight – Cap rates reflect investor sentiment and risk appetite.

Decision Support – Helps investors decide whether a property’s return aligns with their goals.

Limitations and Risks

Incomplete Picture – Cap rate doesn’t account for financing costs, tax implications, or future income growth.

Market Sensitivity – Small changes in NOI or value can swing the rate significantly.

Not Always Comparable – Properties of different types or in different markets may have cap rates that reflect more than just income.

Lesson Takeaways

Cap rates are a starting point — a shorthand way to value risk and return in commercial real estate. But smart operators and investors look beyond the number, weighing market trends, tenant strength, financing structure, and long-term growth potential.

At FCAR Capital Advisors, we help clients interpret cap rates in context and use them as one piece of a comprehensive strategy for acquisition, refinancing, or portfolio growth.