What is Mezzanine Financing? A Flexible Layer of Capital for Growth

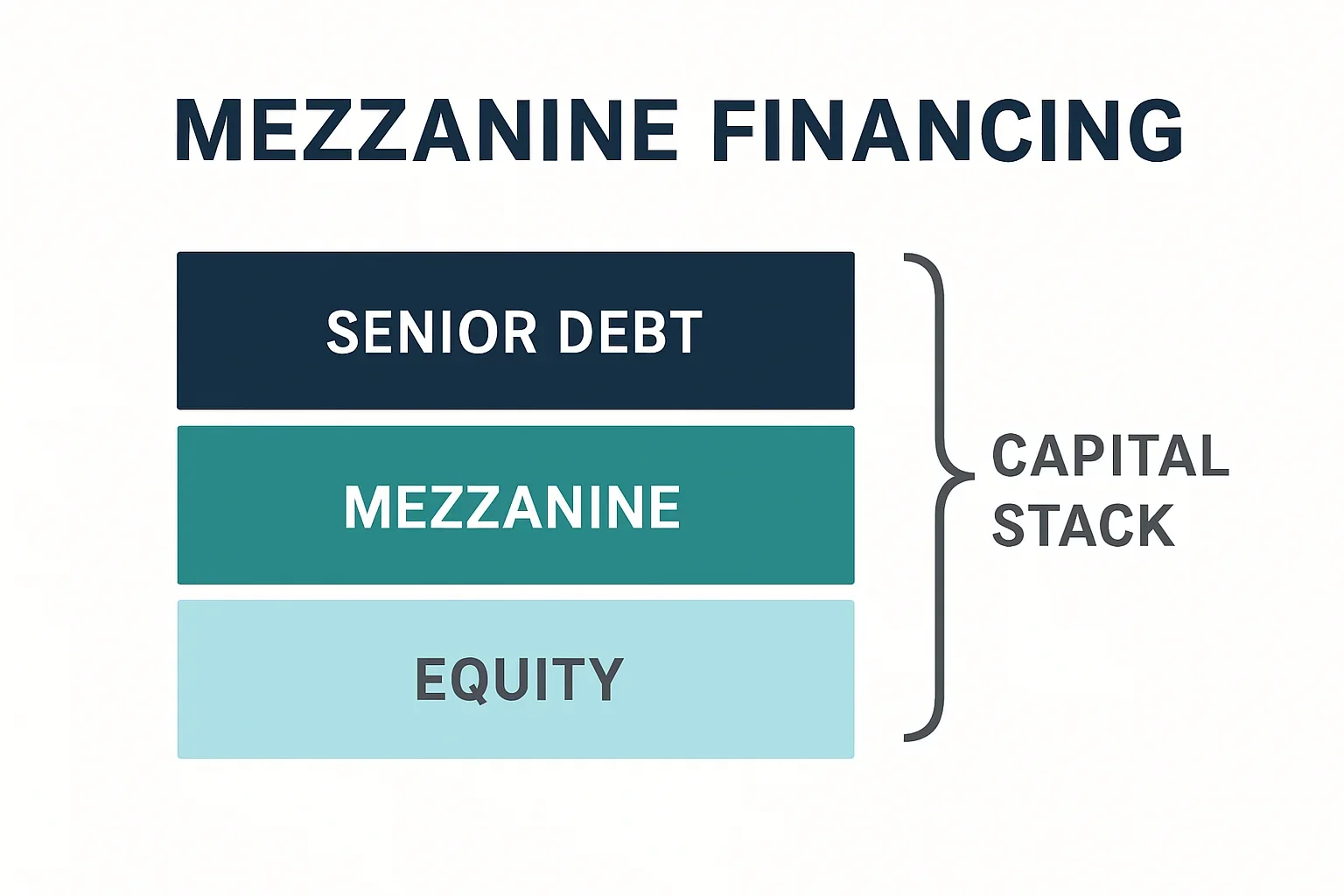

When traditional financing doesn’t cover the full cost of a project, many investors and business operators turn to mezzanine financing. This hybrid form of capital sits between debt and equity, providing a flexible solution that helps close funding gaps without giving up full ownership.

Mezzanine Financing in Simple Terms

Mezzanine financing is essentially a loan backed by equity. If the borrower can’t meet debt obligations, the lender has the right to convert the unpaid balance into an equity stake in the property or company.

It’s often layered on top of a senior loan (like a commercial mortgage) to provide the extra capital needed to complete acquisitions, expansions, or large-scale developments.

Think of mezzanine financing like adding a second floor onto a house. The foundation (senior debt) supports most of the structure, but the mezzanine adds space and flexibility — allowing the project to reach higher than it could with the foundation alone.

Why Borrowers Use Mezzanine Financing

Fill the Gap – When senior lenders cap the loan-to-value (LTV), mezzanine debt bridges the gap between equity and what the senior loan will cover.

Leverage Without Dilution – Provides capital without giving up majority ownership.

Growth Acceleration – Enables businesses and investors to pursue larger or multiple projects sooner.

Benefits

Access to More Capital – Expands financing options beyond traditional lending.

Flexible Structures – Terms can be tailored to project needs.

Preserves Control – Equity dilution only occurs if repayment obligations aren’t met.

Risks

Higher Cost of Capital – Rates are generally higher than senior debt.

Repayment Pressure – Borrowers must balance debt service with project performance.

Potential Equity Loss – Default could result in equity conversion by lenders.

Lesson Takeaways

Mezzanine financing is a powerful tool for investors and operators looking to maximize leverage, preserve ownership, and unlock growth opportunities. At FCAR Capital, we help clients structure mezzanine solutions that complement senior debt and align with long-term goals.